Have you ever found yourself saying; “BUT OUR ESTIMATES ASSUME GUIDELINES ARE FOLLOWED!”

When it comes to loans, lenders must know the likelihood of repayment, whether collateral exists and what it is worth relative to the value of the loan. That’s why there are guidelines! But what happens when there are deviations from the guidelines? In a word, PROBLEMS. In Part III of his series, Charles D. Cowan, Ph.D. describes the impact of misstatements, mis-valuations and macroeconomic changes which directly affect the likelihood of losing or gaining money.

PART III: Deviations From The Guidelines

- Through misstatements of loan and borrower characteristics.

- Through mis-valuation of the underlying collateral.

- Through changes in macroeconomic conditions that affect the likelihood of default when loan information is incorrectly recorded.

Each of these work hand-in-hand in the way they affect the riskiness of a pool of loans. Misstated information and deviations from guidelines can mean that:

- The probabilities of return are incorrect

- The actual return calculation is incorrect

- The understanding of increased risk from an economic downturn is incorrect

Guidelines were developed not only to determine whether the borrower can repay the loan now, but also whether the borrower can repay the loan (in case things get tough). If the borrower doesn’t have sufficient reserves or holds too much debt, an economic downturn will likely have a greater impact on that borrower.

Thus the need for quality control, independent reviews (like due diligence), and stress testing of a portfolio of loans. This is especially true when the people making decisions about the loan or reporting the value of the collateral are incented to make

as many loans as possible, rather than the best loans possible. While those people may benefit from increased originations, they do so by ignoring the increase in risk or in the knowledge that the risk isn’t theirs – it’s yours. If you are buying loans, originating loans and holding them, or insuring loans (or insuring the institutions that hold the loans) you get the risk. If the risk increases, you get the increase.

Want to see how bad it can get? Read on.

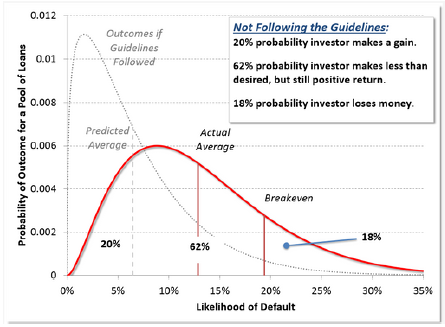

As described earlier, there’s a distribution of possible outcomes for a pool of loans. If one predicts the outcomes for defaults, based on an originator following the guidelines, the mean number of expected defaults is moderate (about 6%), and the proportion of times that the investor or insurer might suffer a loss is low (about 3% of outcomes).

As described earlier, there’s a distribution of possible outcomes for a pool of loans. If one predicts the outcomes for defaults, based on an originator following the guidelines, the mean number of expected defaults is moderate (about 6%), and the proportion of times that the investor or insurer might suffer a loss is low (about 3% of outcomes).If the guidelines are not followed and the likelihood of a default increases for some or all of the loans, then the likelihood of getting the expected return is much lower and the likelihood of losing money is much higher.

In some cases, the likelihood of getting the expected return or better can drop from 60% to 20%. At the same time, the proportion of times the investor or insurer will lose money may rises from 3% to 18%.

Exceeding DTI requirements, insufficient reserves, overstated income.

. . . What did you expect?

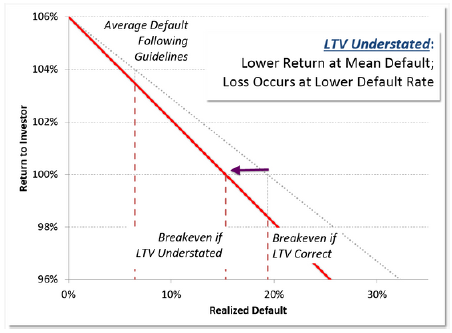

Suppose instead that the Underwriting Guidelines are followed, but the Appraisal overstates the value of the property. If the Appraisal is too high, high and unwarranted sales prices are a result and the Loan-to-Value computed is too low. If there is a default, or for a reasonable proportion of defaults, the recovery from the sale of foreclosed upon properties is lower since the value of the property is lower. This means the return from collateral obtained when foreclosures occur is lower since there is less value available to offset the loss from a default.

Suppose instead that the Underwriting Guidelines are followed, but the Appraisal overstates the value of the property. If the Appraisal is too high, high and unwarranted sales prices are a result and the Loan-to-Value computed is too low. If there is a default, or for a reasonable proportion of defaults, the recovery from the sale of foreclosed upon properties is lower since the value of the property is lower. This means the return from collateral obtained when foreclosures occur is lower since there is less value available to offset the loss from a default.In turn, referring to the previous chart, even if the guidelines are followed, the proportion of times an investor or insurer will lose money is greatly increased since the break-even point between a gain and a loss is lower. In the example above, for a moderate decline in LTV, the break-even point goes from nearly 20% to about 15%. Whenever defaults exceed 15%, there is a loss.

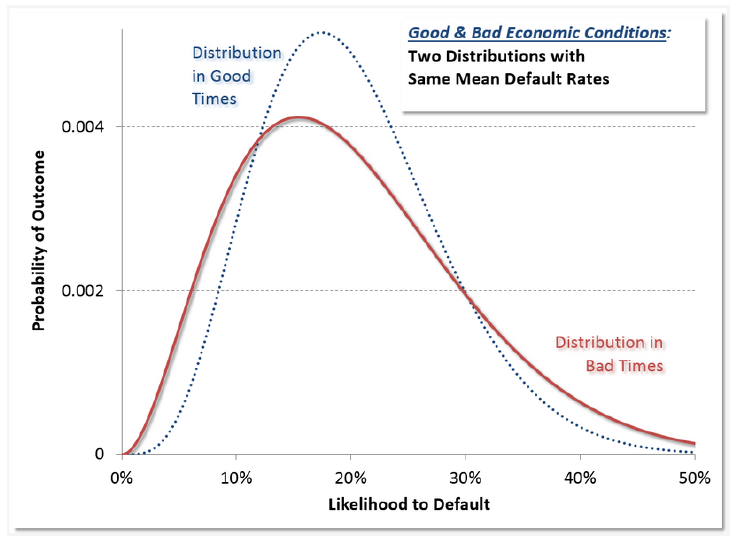

In bad economic times, volatility increases in the economy, so that there may be increasing differences between different parts of the country for unemployment rates, wage increases, and so on. This means there will be more volatility in the possible outcomes from a sale of a portfolio of loans, even when the expected default rate stays the same.

In bad economic times, volatility increases in the economy, so that there may be increasing differences between different parts of the country for unemployment rates, wage increases, and so on. This means there will be more volatility in the possible outcomes from a sale of a portfolio of loans, even when the expected default rate stays the same.

The effect of these two changes in the economy is to increase the risk associated with the pool of loans. Even if the average values for the distribution of outcomes are the same, the volatility in the mortgage market increases, meaning that there is a much greater likelihood of extreme losses. Again, the savvy investor looks not only at what may be gained but also how big a loss may occur. Even with no change in the mean default risk of loss goes up, up, up.